Does The IRS Monitor Your Bank Account?

Does The Irs Look At Your Bank is an interrogative sentence that inquires whether the Internal Revenue Service (IRS) examines a person's bank account. For instance, during an audit, the IRS may request bank statements to verify reported income and deductions.

Understanding Does The Irs Look At Your Bank is essential for taxpayers as it can impact their financial planning and compliance with tax laws. By knowing the IRS's authority and limitations, individuals can make informed decisions and avoid potential penalties. Historically, the IRS has expanded its powers to monitor financial transactions, highlighting the importance of transparency and proper record-keeping.

This article delves into the specific circumstances in which Does The Irs Look At Your Bank, exploring the legal basis, procedures involved, and implications for taxpayers.

Read also:Yuliya Levchenko Nude The Untold Story Behind The Viral Sensation

Does The Irs Look At Your Bank

Understanding the essential aspects of Does The Irs Look At Your Bank is crucial for taxpayers, as it can impact their financial planning and tax compliance.

- Legal Authority

- Audit Process

- Bank Secrecy Act

- Tax Evasion

- Tax Fraud

- Innocent Spouse Relief

- Statute of Limitations

- Taxpayer Protections

These aspects encompass the legal basis for the IRS's authority, the procedures involved in bank account examinations, the consequences of tax violations, and the rights and protections available to taxpayers. By delving into these key elements, individuals can gain a comprehensive understanding of Does The Irs Look At Your Bank and make informed decisions regarding their financial affairs.

Legal Authority

The legal authority for Does The Irs Look At Your Bank stems from the Internal Revenue Code, which grants the IRS broad powers to examine taxpayer records, including bank accounts, to ensure compliance with tax laws.

- Statutory Authority: The Internal Revenue Code provides the legal basis for the IRS to examine taxpayer records, including bank accounts, to verify the accuracy of tax returns and assess potential tax liabilities.

- Summons Authority: The IRS has the authority to issue summonses to banks and other financial institutions, compelling them to produce records related to a taxpayer's financial transactions.

- Third-Party Reporting: Banks and other financial institutions are required by law to report certain types of financial transactions to the IRS, such as large cash deposits or withdrawals. This information can be used by the IRS to identify potential tax fraud or non-compliance.

- Court Orders: In some cases, the IRS may obtain a court order to compel a bank to produce records related to a taxpayer's financial transactions. This is typically done when the IRS has reason to believe that the taxpayer is attempting to conceal assets or evade taxes.

These legal authorities provide the IRS with a wide range of tools to examine taxpayer bank accounts and ensure compliance with tax laws. Taxpayers should be aware of these authorities and the potential consequences of failing to comply with IRS requests for information.

Audit Process

Audit Process is a crucial aspect of Does The Irs Look At Your Bank, as it outlines the steps involved in an IRS audit and the potential consequences for taxpayers.

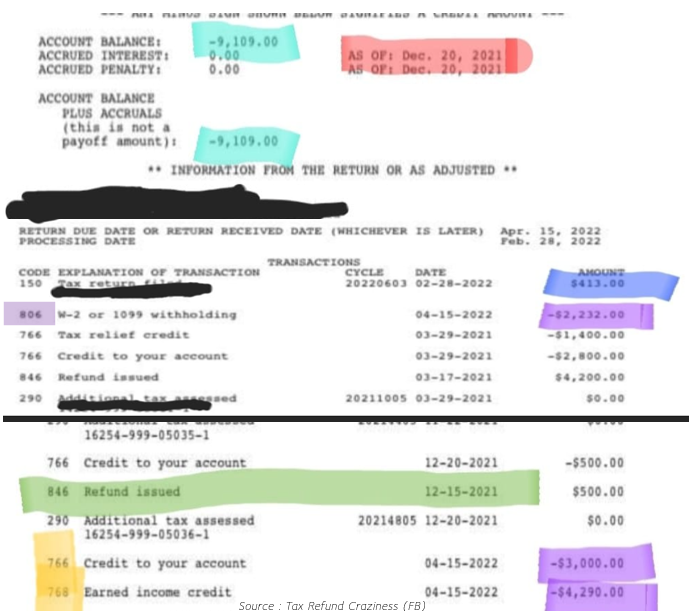

- Examination: The IRS will review the taxpayer's bank statements,,, and other financial records to verify the accuracy of the reported income and expenses.

- Subpoenas: The IRS may issue subpoenas to banks and other financial institutions to obtain additional records related to the taxpayer's financial transactions.

- Interviews: The IRS may interview the taxpayer, their accountant, or other relevant parties to gather information about the taxpayer's financial activities.

- Negotiation: If the IRS believes that the taxpayer owes additional taxes, it will negotiate with the taxpayer to settle the tax liability.

Understanding the Audit Process is essential for taxpayers, as it can help them prepare for an audit and minimize the potential risks. Taxpayers should keep accurate financial records, be prepared to provide documentation to support their tax return, and consider seeking professional advice from an accountant or tax attorney if they are facing an audit.

Read also:Will Smith Nude The Untold Story Behind The Controversy And Its Impact

Bank Secrecy Act

The Bank Secrecy Act (BSA) is a critical aspect of Does The Irs Look At Your Bank, as it imposes various requirements on banks and other financial institutions to help prevent money laundering and other financial crimes.

- Currency Transaction Reports (CTRs): Banks are required to file CTRs for cash transactions that exceed $10,000. This helps the IRS track large cash transactions that could be used for illegal activities.

- Suspicious Activity Reports (SARs): Banks are also required to file SARs when they suspect that a customer is engaged in suspicious or illegal activities. This includes transactions that are inconsistent with the customer's known business or financial profile.

- Customer Identification Program (CIP): Banks are required to implement a CIP to identify and verify the identity of their customers. This helps prevent criminals from using anonymous accounts to launder money or finance illegal activities.

- Recordkeeping Requirements: Banks are required to maintain records of all financial transactions for at least five years. This helps the IRS and other law enforcement agencies investigate financial crimes.

The BSA plays a vital role in Does The Irs Look At Your Bank, as it provides the IRS with valuable information that can be used to identify and investigate potential tax fraud and other financial crimes. By requiring banks to report suspicious activities and maintain detailed records, the BSA helps the IRS ensure that taxpayers are complying with their tax obligations and that the financial system is not being used for illegal purposes.

Tax Evasion

Tax evasion is a serious issue that can have severe consequences. It occurs when a taxpayer deliberately fails to report all of their income or overstates their deductions or credits on their tax return. The IRS has a number of tools at its disposal to detect and investigate tax evasion, including the ability to examine a taxpayer's bank records.

- Hiding Income: Taxpayers may hide income by failing to report all of their income sources, such as wages, self-employment income, or investment income. They may also understate the amount of income they receive from these sources.

- Overstating Deductions: Taxpayers may overstate their deductions or credits to reduce their tax liability. This can include claiming deductions for expenses that are not actually deductible, or inflating the amount of deductible expenses.

- Using False Documents: Taxpayers may use false documents to support their tax return, such as fake receipts or invoices. This can be done to hide income or overstate deductions.

- Offshore Accounts: Taxpayers may use offshore accounts to hide their assets and income from the IRS. This can make it difficult for the IRS to detect and investigate tax evasion.

Tax evasion is a serious crime that can result in significant penalties, including fines, imprisonment, and asset forfeiture. The IRS is actively pursuing tax evaders and has a number of tools at its disposal to detect and investigate tax evasion. Taxpayers who are considering evading their taxes should be aware of the risks involved and should seek professional advice from a qualified tax advisor.

Tax Fraud

Tax fraud is a serious offense that involves intentionally deceiving the IRS about your tax liability. It can take many forms, including:

- Filing False Returns: This involves submitting a tax return that contains false or misleading information about your income, deductions, or credits.

- Hiding Income: This involves failing to report all of your income to the IRS, such as income from a side job or investments.

- Claiming False Deductions: This involves taking deductions for expenses that you are not entitled to take, or inflating the amount of your deductible expenses.

- Using Offshore Accounts: This involves hiding your assets and income in offshore accounts to avoid paying taxes on them.

Tax fraud is a serious crime that can result in significant penalties, including fines, imprisonment, and asset forfeiture. The IRS is actively pursuing tax fraud cases, and has a number of tools at its disposal to detect and investigate tax fraud, including the ability to examine a taxpayer's bank records. If you are considering committing tax fraud, you should be aware of the risks involved and should seek professional advice from a qualified tax advisor.

Innocent Spouse Relief

In the context of Does The Irs Look At Your Bank, understanding Innocent Spouse Relief is crucial, as it provides relief to spouses who are held liable for taxes and penalties due to the fraudulent actions of their partner.

- Definition: Innocent spouse relief is a provision that allows a spouse to be relieved of liability for tax debts that are primarily the responsibility of their spouse.

- Eligibility: To qualify for innocent spouse relief, the spouse must meet certain criteria, such as demonstrating that they did not know about their spouse's fraudulent activities and that they did not benefit from the fraudulent actions.

- Procedures: To apply for innocent spouse relief, the spouse must file Form 8857, Request for Innocent Spouse Relief, with the IRS.

- Limitations: Innocent spouse relief is not available in all cases, and the IRS may deny relief if the spouse knew or should have known about their spouse's fraudulent activities.

Understanding innocent spouse relief is essential for taxpayers who are facing tax liability due to the actions of their spouse. By meeting the eligibility criteria and following the proper procedures, spouses may be able to obtain relief from tax debts that are not their responsibility.

Statute of Limitations

The statute of limitations is a critical component of Does The Irs Look At Your Bank, as it establishes the time period during which the IRS can assess additional taxes or take collection actions against a taxpayer.

Generally, the IRS has three years from the date a tax return is filed to assess additional taxes. However, there are exceptions to this rule, such as when a taxpayer files a fraudulent return or fails to file a return altogether. In these cases, the IRS may have more time to assess additional taxes.

The statute of limitations also affects the IRS's ability to collect unpaid taxes. The IRS has ten years from the date of assessment to collect unpaid taxes. However, if the taxpayer enters into an installment agreement with the IRS, the statute of limitations may be extended.

Understanding the statute of limitations is essential for taxpayers, as it can impact their financial planning and tax compliance. Taxpayers should be aware of the time limits for assessing additional taxes and collecting unpaid taxes, and they should take steps to comply with their tax obligations within these time frames.

Taxpayer Protections

Taxpayer protections are essential safeguards that help ensure that taxpayers are treated fairly and equitably by the IRS. These protections play a crucial role in the context of "Does The Irs Look At Your Bank", as they limit the IRS's authority to examine taxpayer bank accounts and protect taxpayers from potential abuse or harassment.

One of the most important taxpayer protections is the Fourth Amendment to the U.S. Constitution, which protects against unreasonable searches and seizures. This means that the IRS cannot simply examine a taxpayer's bank account without first obtaining a warrant. In order to obtain a warrant, the IRS must demonstrate to a judge that there is probable cause to believe that the taxpayer has committed a tax crime.

Another important taxpayer protection is the Taxpayer Bill of Rights, which was enacted in 1988. The Taxpayer Bill of Rights established a number of rights for taxpayers, including the right to be informed of their rights, the right to representation, and the right to appeal IRS decisions. These rights help to ensure that taxpayers are treated fairly and respectfully by the IRS.

Taxpayer protections are essential for ensuring that taxpayers are treated fairly and equitably by the IRS. These protections limit the IRS's authority to examine taxpayer bank accounts and protect taxpayers from potential abuse or harassment. Taxpayers should be aware of their rights and protections, and they should not hesitate to assert these rights if they are being treated unfairly by the IRS.

This article has explored the complexities of Does The Irs Look At Your Bank, highlighting the legal authority, procedures, and implications involved. Key takeaways include the IRS's broad powers to examine bank accounts, the importance of taxpayer protections, and the consequences of tax evasion and fraud. These elements are interconnected, shaping the landscape of taxpayer compliance and the IRS's enforcement efforts.

The insights gained from this exploration emphasize the significance of responsible tax practices, record-keeping, and seeking professional advice when necessary. Taxpayers should be aware of their rights and obligations, ensuring transparency and minimizing potential risks. The IRS's role in maintaining a fair and equitable tax system remains crucial, highlighting the importance of continued dialogue and collaboration between taxpayers and the agency.