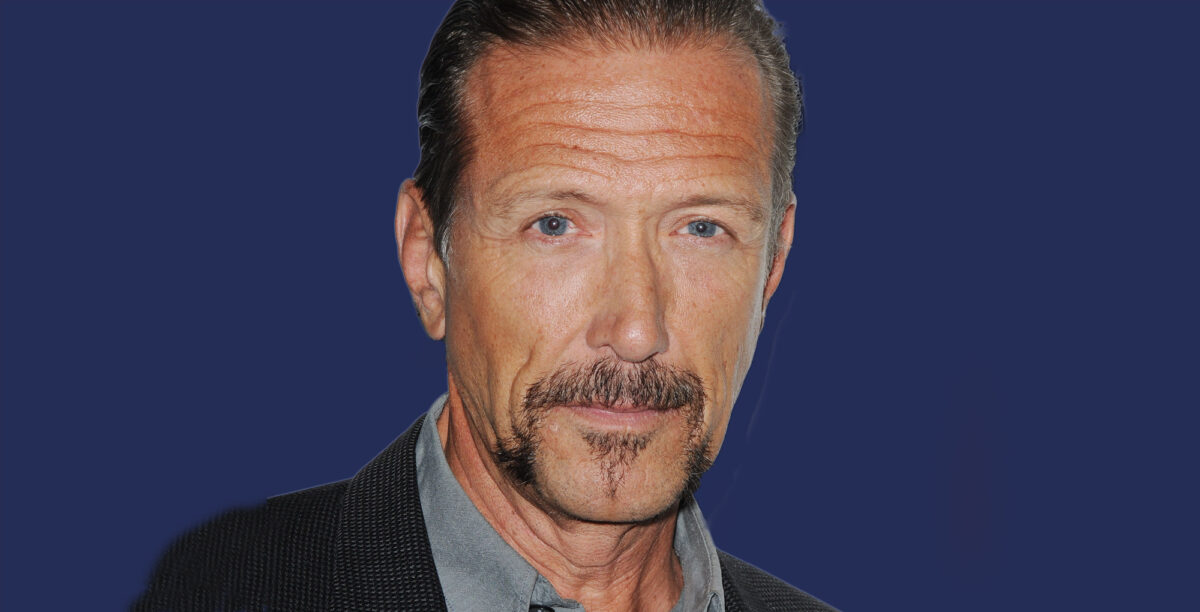

Unveiling Walt Willey's Financial Success: Net Worth, Income, And Career Earnings

Walt Willey Net Worth Income Salary Earnings, an economic term, represents the financial status of an individual, encompassing various sources of income, including salaries, earnings from investments, and other monetary assets.

Understanding this concept holds great relevance as it provides insights into an individual's financial stability, wealth accumulation, and overall economic well-being. Historically, the calculation of net worth has evolved over time, with the inclusion of retirement accounts and other investment vehicles.

This article delves into the intricacies of Walt Willey's net worth, exploring his income streams, salary structure, and the factors contributing to his financial success.

Read also:Karyn Parsons Nude Debunking Myths And Exploring The Real Story

Walt Willey Net Worth Income Salary Earnings

Understanding the various dimensions of Walt Willey's Net Worth, Income, Salary, and Earnings is crucial for gaining a comprehensive view of his financial status. These aspects provide insights into his wealth accumulation, spending habits, and overall economic well-being.

- Net Worth: Total value of assets minus liabilities.

- Income: Earnings from employment, investments, or other sources.

- Salary: Fixed compensation for work performed.

- Earnings: Income from various sources, including bonuses, commissions, and royalties.

- Investments: Assets acquired with the expectation of future profit.

- Assets: Possessions with monetary value, such as property, vehicles, and investments.

- Liabilities: Debts or financial obligations owed to others.

- Expenses: Costs incurred for personal or business purposes.

- Financial Stability: Measure of an individual's ability to withstand financial setbacks.

An individual's net worth is influenced by various factors, including career earnings, investment returns, and lifestyle choices. Analyzing these aspects can provide valuable insights into an individual's financial acumen, risk tolerance, and overall financial trajectory.

Net Worth

Within the context of "Walt Willey Net Worth Income Salary Earnings", net worth serves as a crucial indicator of his financial well-being. It represents the total value of his assets, minus any outstanding liabilities, providing a snapshot of his overall financial position.

- Assets: Possessions or resources with monetary value, such as real estate, investments, vehicles, and artwork.

- Liabilities: Debts or financial obligations owed to others, including mortgages, loans, and credit card balances.

- Asset Appreciation: Increase in the value of assets over time, positively impacting net worth.

- Debt Repayment: Reduction of liabilities, leading to a higher net worth.

By understanding the components of net worth, one can gain valuable insights into Walt Willey's financial strategy, risk tolerance, and overall wealth management approach. A higher net worth generally indicates financial stability, a lower risk of bankruptcy, and greater access to investment opportunities.

Income

Within the context of "Walt Willey Net Worth Income Salary Earnings", understanding the various streams of income that contribute to his overall financial picture is essential. Income encompasses earnings from employment, investments, and other sources, providing a comprehensive view of his financial well-being.

- Employment Income: Earnings from regular employment, including salaries, wages, bonuses, and commissions.

- Investment Income: Returns on investments, such as dividends, interest, rental income, and capital gains.

- Passive Income: Earnings from sources that require minimal ongoing effort, such as royalties, patents, and affiliate marketing.

- Other Income: Earnings from various sources not falling into the above categories, such as freelance work, side hustles, or lottery winnings.

Analyzing Walt Willey's income streams can provide insights into his career trajectory, investment strategies, and overall financial diversification. A diverse income portfolio, with a mix of active and passive income sources, can contribute to financial stability and resilience.

Read also:Layla Kay Nude A Closer Look At The Controversy And Facts

Salary

Within the context of "Walt Willey Net Worth Income Salary Earnings", salary plays a pivotal role in shaping his overall financial picture. Salary, being a fixed compensation for work performed, forms a critical component of his income. It represents the regular earnings that contribute to his financial stability and overall net worth growth.

Walt Willey's salary, combined with other sources of income such as investments and passive income streams, contributes significantly to his net worth. A stable and substantial salary provides a solid foundation for financial planning, allowing him to meet his living expenses, invest for the future, and build wealth over time.

Understanding the connection between salary and net worth is crucial for individuals seeking financial stability and long-term wealth accumulation. By securing a steady income source, one can establish a strong foundation for financial growth, reduce reliance on debt, and pursue investment opportunities that can further enhance their net worth.

Earnings

Within the context of "Walt Willey Net Worth Income Salary Earnings", examining the role of earnings, encompasses a diverse range of income sources beyond fixed salaries, provides a comprehensive understanding of his overall financial picture. These earnings, including bonuses, commissions, and royalties, contribute significantly to his net worth growth and financial stability.

Earnings, often tied to performance, incentives, or creative endeavors, serve as a critical component of Walt Willey's income portfolio. Bonuses, for instance, reward exceptional job performance, while commissions offer incentives for sales achievements. Royalties, on the other hand, provide ongoing income streams from creative works, such as music, writing, or inventions.

Understanding the connection between earnings and net worth is crucial for individuals seeking financial success. By diversifying income sources and pursuing opportunities for additional earnings, one can increase their earning potential and accelerate wealth accumulation. This understanding empowers individuals to explore new ventures, invest in themselves, and secure their financial future.

Investments

In the examination of "Walt Willey Net Worth Income Salary Earnings," understanding the role of investments is paramount. Investments, defined as assets acquired with the expectation of future profit, contribute significantly to Walt Willey's financial well-being and play a crucial role in his overall wealth accumulation.

- Stocks: Ownership shares in publicly traded companies, offering potential for capital appreciation and dividends.

- Bonds: Loans made to corporations or governments, providing fixed interest payments and principal repayment at maturity.

- Real Estate: Land and buildings acquired for rental income, capital appreciation, or both.

- Private Equity: Investments in privately held companies, offering potential for high returns but also higher risk.

These diverse investments serve as a means for Walt Willey to grow his wealth over time, generate passive income, and mitigate financial risk. By allocating a portion of his income and earnings towards investments, he enhances his financial stability and increases his potential for long-term financial success.

Assets

Understanding the various types of assets that comprise Walt Willey's net worth is crucial for gaining insights into his financial standing and overall wealth management strategy. Assets, defined as possessions with monetary value, encompass a wide range of tangible and intangible properties, each contributing to his financial well-being.

- Real Estate: Land, buildings, and other real properties can be valuable assets that appreciate in value over time and generate rental income.

- Stocks and Bonds: Investments in stocks and bonds represent ownership stakes in companies and lendable capital, respectively, offering potential returns in the form of dividends, interest payments, and capital gains.

- Vehicles: Cars, trucks, and other vehicles, while depreciating assets, can hold value and provide essential transportation.

- Intellectual Property: Patents, trademarks, and copyrights are intangible assets that represent ownership of unique creations and innovations, potentially generating royalties and licensing fees.

These assets, along with other valuable possessions, collectively contribute to Walt Willey's net worth, providing financial security, potential income streams, and opportunities for wealth growth. By carefully managing and investing in these assets, he can enhance his financial stability and secure his long-term financial future.

Liabilities

Within the context of "Walt Willey Net Worth Income Salary Earnings," understanding the various types of liabilities he owes is essential for gaining a comprehensive view of his financial standing and overall wealth management strategy. Liabilities represent debts or financial obligations that must be repaid or settled, and they can significantly impact his net worth and financial well-being.

- Mortgages: Loans secured by real estate, typically used to finance the purchase of a home, which can be a significant liability but also a form of investment.

- Loans: Debts incurred for various purposes, such as education, vehicles, or personal expenses, which can accumulate interest and affect Walt Willey's cash flow.

- Credit Card Debt: Revolving debt that can accumulate quickly if not managed responsibly, potentially leading to high-interest charges and damage to credit scores.

- Taxes: Financial obligations owed to government entities, including income taxes, property taxes, and sales taxes, which can fluctuate depending on income and location.

These liabilities, along with other financial obligations, can influence Walt Willey's financial decision-making, impact his ability to save and invest, and affect his overall financial stability. Managing liabilities effectively, such as paying down debt and minimizing interest charges, is crucial for preserving his net worth and securing his long-term financial health.

Expenses

Understanding the various types of expenses incurred by Walt Willey is crucial for gaining a comprehensive view of his financial management strategy and overall financial well-being. Expenses can significantly impact his net worth and cash flow, and managing them effectively is essential for preserving and growing his wealth.

- Fixed Expenses: These are regular, consistent expenses that remain relatively constant over time, such as mortgage or rent payments, car payments, and insurance premiums. These expenses are essential for maintaining a certain standard of living and financial obligations.

- Variable Expenses: These expenses fluctuate depending on usage or consumption, such as groceries, utilities, entertainment, and dining out. Managing variable expenses effectively can help control overall spending and improve cash flow.

- Discretionary Expenses: These expenses are non-essential and can be adjusted or eliminated without significantly impacting one's lifestyle, such as travel, hobbies, and luxury items. Careful management of discretionary expenses can free up funds for saving, investing, or reducing debt.

- Business Expenses: If Walt Willey owns a business, expenses related to its operation, such as salaries, rent, and marketing costs, should be considered. These expenses are necessary for generating income and maintaining the business's operations.

By categorizing and tracking his expenses, Walt Willey can identify areas where he can optimize his spending, reduce unnecessary costs, and allocate his resources more efficiently. Effective expense management is a cornerstone of sound financial planning and wealth accumulation.

Financial Stability

Financial stability, often measured by an individual's net worth, income, salary, and earnings, serves as a critical indicator of their ability to withstand financial setbacks. A strong financial foundation, characterized by a healthy net worth and a steady income stream, provides a buffer against unexpected expenses, job loss, or economic downturns. In the context of "Walt Willey Net Worth Income Salary Earnings," understanding his financial stability is paramount for assessing his overall financial well-being.

Walt Willey's net worth, encompassing his assets, investments, and income sources, plays a significant role in his financial stability. A higher net worth provides him with greater financial flexibility and resilience. For instance, during a period of unemployment, he could rely on his savings and investments to cover essential expenses and maintain his standard of living. Similarly, a steady income stream, such as a regular salary or passive income from investments, ensures a consistent flow of funds to meet ongoing expenses and financial obligations.

Real-life examples further illustrate the practical significance of financial stability. Individuals with a stable financial foundation are better equipped to handle unexpected medical expenses, home repairs, or car troubles. They are less likely to fall into debt or face financial distress during economic downturns. In contrast, those with limited financial stability may struggle to cope with financial setbacks, potentially leading to credit problems, stress, or even bankruptcy.

Understanding the connection between financial stability and "Walt Willey Net Worth Income Salary Earnings" empowers individuals to make informed financial decisions. By building a strong net worth, securing a stable income, and managing expenses effectively, individuals can increase their financial resilience and prepare for potential financial challenges.

In summary, the exploration of "Walt Willey Net Worth Income Salary Earnings" has unveiled the intricate components that contribute to his overall financial picture. His net worth, encompassing assets, investments, and income streams, serves as a measure of his financial stability and wealth accumulation. Understanding the dynamics of salary, earnings, investments, assets, liabilities, expenses, and financial stability provides valuable insights into Walt Willey's financial management strategies and overall financial well-being.

Key takeaways from this analysis include the significance of diversifying income sources, investing wisely to grow wealth, and managing expenses effectively to maintain financial stability. These elements are interconnected and play a crucial role in building a solid financial foundation. By carefully navigating these aspects, individuals can enhance their financial resilience, prepare for unforeseen circumstances, and achieve long-term financial success.