Unveiling Isla Fisher's Net Worth: Everything You Need To Know

Isla Fisher Net Worth How Much Is Fisher: Calculate an individual's financial standing based on their assets, liabilities, and income.

Assessing Isla Fisher Net Worth How Much Is Fisher provides insight into financial stability, investment potential, and overall wealth. It's crucial for financial planning, credit applications, and business decisions.

Historically, Isla Fisher Net Worth How Much Is Fisher was calculated manually. Today, online tools and calculators automate the process, simplifying the task.

Read also:South Park Nude A Comprehensive Look Into The Controversy And Creativity

Isla Fisher Net Worth How Much Is Fisher

Understanding the essential aspects of Isla Fisher Net Worth How Much Is Fisher is crucial for assessing financial stability and wealth.

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Savings

- Debt

- Cash flow

- Financial goals

These aspects provide a comprehensive view of an individual's financial health. By analyzing these elements, one can make informed decisions about budgeting, saving, and investing.

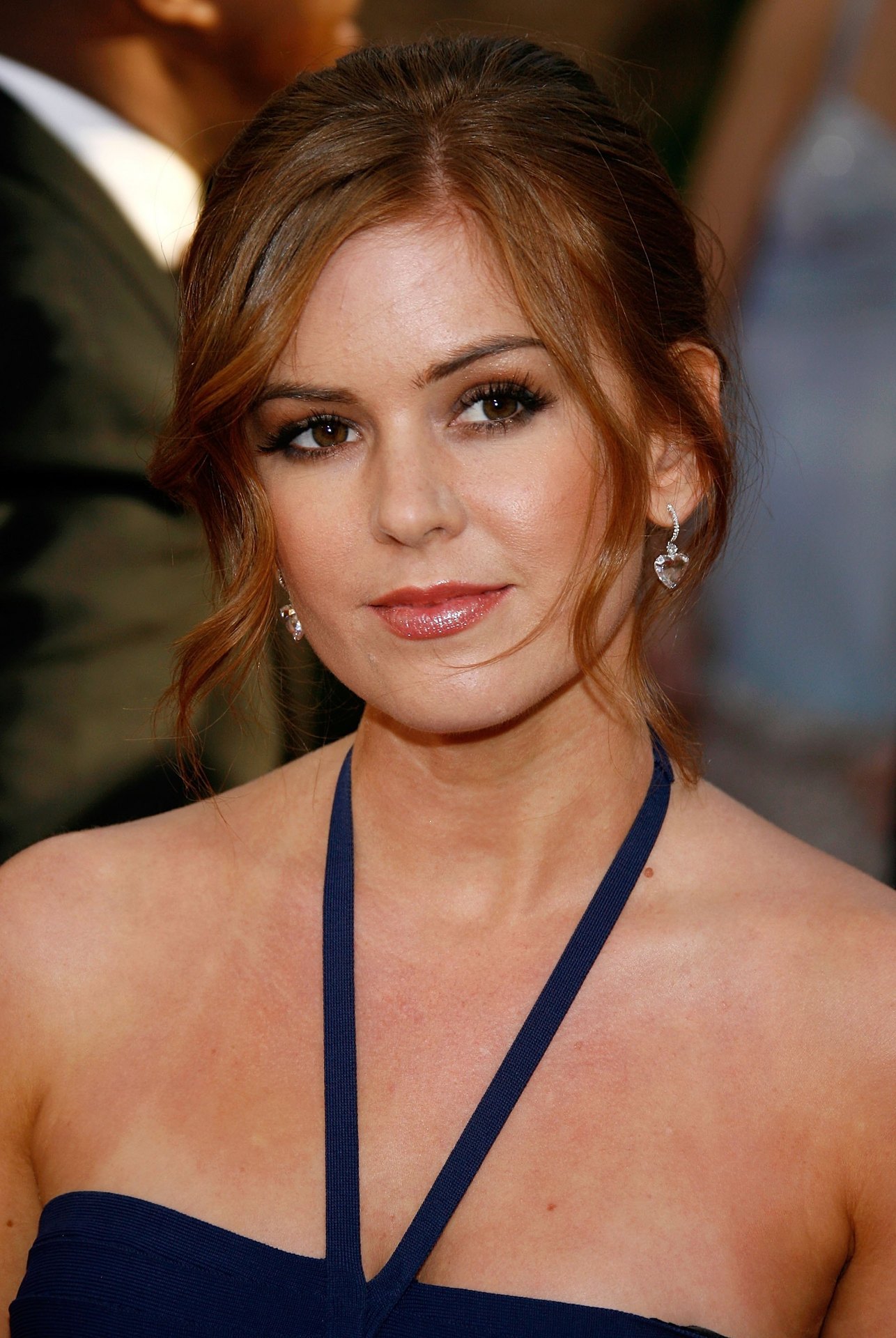

| Name | Birth Date | Birth Place | Occupation | Net Worth |

|---|---|---|---|---|

| Isla Fisher | February 3, 1976 | Muscat, Oman | Actress, Author | $16 million |

Assets

In the context of Isla Fisher Net Worth How Much Is Fisher, assets refer to valuable possessions or resources owned by an individual or organization that contribute to their financial well-being and overall net worth. Assets are crucial in determining financial stability, liquidity, and borrowing capacity.

For Isla Fisher, her assets may include tangible assets such as real estate, vehicles, jewelry, and artwork. Additionally, intangible assets like investments, intellectual property, and business interests also contribute to her net worth. By accumulating and managing her assets effectively, Isla Fisher can increase her financial security and generate passive income.

Understanding the relationship between assets and net worth is essential for effective financial planning and decision-making. Assets are a cornerstone of financial stability, providing a buffer against unexpected expenses or financial setbacks. Furthermore, assets can be leveraged to secure loans or investments, further enhancing wealth-building opportunities.

Liabilities

Within the context of Isla Fisher Net Worth How Much Is Fisher, liabilities encompass financial obligations and debts that must be repaid or settled, acting as a counterbalance to assets and reducing overall net worth.

Read also:Brad Greenquist Nude The Truth Behind The Clickbait And Sensationalism

- Outstanding Loans

Outstanding loans, such as mortgages, auto loans, and personal loans, represent significant liabilities, impacting cash flow and overall financial flexibility.

- Unpaid Bills

Unpaid bills, including utility bills, credit card balances, and medical expenses, can accumulate and strain financial resources if not managed responsibly.

- Taxes Owed

Taxes owed, such as income taxes and property taxes, are legal obligations that must be fulfilled, potentially reducing disposable income and affecting net worth.

- Contingent Liabilities

Contingent liabilities, such as guarantees or potential lawsuits, represent potential future financial obligations that may materialize and impact overall financial standing.

Understanding and managing liabilities is crucial for maintaining financial stability and preserving net worth. By addressing liabilities proactively, Isla Fisher can minimize their impact on her financial well-being and maximize her wealth-building opportunities.

Income

Within the context of Isla Fisher Net Worth How Much Is Fisher, income plays a crucial role in determining her financial well-being and overall net worth. It represents the inflow of funds from various sources, which can be used to cover expenses, accumulate assets, and build wealth.

- Earnings from Employment

As an actress and author, Isla Fisher's primary source of income is her earnings from acting in movies, television shows, and stage productions, as well as royalties and advances from book sales.

- Investment Income

Isla Fisher may invest her earnings in various financial instruments, such as stocks, bonds, and real estate, generating passive income through dividends, interest, and rental income.

- Business Income

In addition to her acting and writing career, Isla Fisher may engage in entrepreneurial ventures or side hustles, generating additional income streams.

- Other Income

Other sources of income may include endorsements, sponsorships, and royalties from previous works, contributing to Isla Fisher's overall financial picture.

By diversifying her income streams and managing her finances effectively, Isla Fisher can increase her financial resilience, maximize wealth accumulation, and achieve her long-term financial goals.

Expenses

Expenses are an essential aspect of Isla Fisher Net Worth How Much Is Fisher, representing the outflow of funds used to pay for goods, services, and other obligations. Managing expenses effectively is crucial for maintaining financial stability, achieving financial goals, and maximizing wealth accumulation.

- Living Expenses

Living expenses encompass essential costs associated with maintaining a household and lifestyle, including rent or mortgage payments, utilities, groceries, and transportation.

- Taxes

Taxes, such as income tax, property tax, and sales tax, are mandatory payments made to government entities, reducing disposable income and impacting net worth.

- Debt Repayments

Debt repayments, such as mortgage payments, car loans, and credit card bills, represent obligations that must be fulfilled, affecting cash flow and overall financial flexibility.

- Entertainment and Leisure

Expenses incurred for entertainment and leisure activities, such as dining out, travel, and hobbies, contribute to personal enjoyment but can also impact financial well-being if not managed responsibly.

By carefully tracking and categorizing her expenses, Isla Fisher can identify areas for optimization, reduce unnecessary spending, and allocate her financial resources more effectively. This proactive approach to expense management is key to building and maintaining a strong financial foundation.

Investments

Investments form a crucial component of Isla Fisher's financial portfolio and contribute significantly to her overall net worth. By allocating funds into various investment vehicles, Isla Fisher aims to grow her wealth over time, generate passive income, and secure her financial future.

- Stocks and Bonds

Stocks and bonds are traditional investment options that involve purchasing shares in companies or lending money to governments or corporations. They offer the potential for capital appreciation and dividend or interest income.

- Real Estate

Real estate investments, such as purchasing residential or commercial properties, provide the potential for rental income, capital gains, and tax benefits. Isla Fisher may own properties for investment purposes, diversifying her portfolio and generating passive income.

- Private Equity and Venture Capital

Private equity and venture capital involve investing in early-stage or privately held companies. These investments offer the potential for high returns but also carry higher risks. Isla Fisher may allocate a portion of her portfolio to these alternative investment classes to enhance her return potential.

- Alternative Investments

Alternative investments, such as commodities, hedge funds, and collectibles, provide diversification and the potential to hedge against market volatility. Isla Fisher may explore these investments to further enhance her portfolio's risk-return profile.

Isla Fisher's investment strategy likely involves a combination of these asset classes, tailored to her individual risk tolerance, financial goals, and time horizon. By managing her investments prudently and seeking professional advice when necessary, she can maximize the potential for long-term wealth creation and financial security.

Savings

Savings, a critical aspect of Isla Fisher Net Worth How Much Is Fisher, refers to the portion of income set aside for future financial needs and goals. By saving consistently and prudently, Isla Fisher can accumulate wealth, achieve financial security, and prepare for unexpected expenses or future financial obligations.

- Emergency Fund

An emergency fund is a dedicated savings account set aside to cover unexpected expenses, such as medical emergencies, car repairs, or job loss. Having an emergency fund can provide peace of mind and prevent the need to resort to debt or high-interest loans.

- Retirement Savings

Retirement savings, often invested in tax-advantaged accounts such as 401(k)s or IRAs, help individuals accumulate funds for their post-work years. Regular contributions and long-term growth potential can help ensure a comfortable retirement lifestyle.

- Short-Term Savings Goals

Short-term savings goals may include saving for a down payment on a house, a new car, or a vacation. These goals require consistent saving over a shorter time horizon and can help Isla Fisher achieve specific financial milestones.

- Long-Term Savings Goals

Long-term savings goals, such as saving for children's education or a comfortable retirement, necessitate a disciplined and long-term approach to saving. These goals often involve investing in a diversified portfolio of stocks, bonds, and other assets.

By prioritizing savings and allocating funds wisely across these different categories, Isla Fisher can build a strong financial foundation, safeguard her financial future, and reach her financial aspirations. Savings is a cornerstone of financial well-being, allowing individuals to weather financial storms, pursue their goals, and achieve financial independence.

Debt

In the context of Isla Fisher Net Worth How Much Is Fisher, understanding debt is crucial for assessing financial well-being and net worth. Debt refers to financial obligations that must be repaid, potentially impacting cash flow, investment decisions, and overall financial stability.

- Outstanding Loans

Outstanding loans, such as mortgages, auto loans, and personal loans, represent significant debt obligations that reduce disposable income and may affect borrowing capacity.

- Credit Card Debt

Accumulated unpaid balances on credit cards contribute to debt, potentially leading to high-interest charges and negatively impacting credit scores.

- Unpaid Bills

Unpaid bills, including utility bills, medical expenses, and taxes, can accumulate and strain financial resources, hindering financial stability.

- Contingent Liabilities

Contingent liabilities, such as guarantees or potential lawsuits, represent potential future financial obligations that may materialize and impact net worth.

Managing debt effectively is essential for Isla Fisher to maintain financial stability, maximize wealth accumulation, and achieve long-term financial goals. By addressing debt obligations proactively, she can minimize their impact on her financial well-being and preserve her net worth.

Cash Flow

Cash flow, a critical component of Isla Fisher Net Worth How Much Is Fisher, refers to the movement of money in and out of a business or individual's financial accounts over a specific period. Understanding and managing cash flow is essential for financial stability, business growth, and wealth accumulation.

Positive cash flow, when more money flows in than out, contributes directly to an increase in net worth. This allows Isla Fisher to invest in new projects, expand her business ventures, or save for the future. Conversely, negative cash flow, when expenses exceed income, can strain financial resources and hinder wealth accumulation.

For example, if Isla Fisher's acting career generates significant income in a particular year, resulting in positive cash flow, she can allocate a portion of those earnings towards investments that have the potential to grow her wealth over time. On the other hand, if she experiences a period of low income or high expenses, resulting in negative cash flow, she may need to adjust her spending habits or explore additional income streams to maintain financial stability.

By understanding and managing her cash flow effectively, Isla Fisher can make informed financial decisions that contribute to her overall net worth growth and long-term financial well-being.

Financial goals

Financial goals are a crucial component of Isla Fisher Net Worth How Much Is Fisher as they provide direction and purpose to her financial decisions. Setting clear and achievable financial goals allows Isla Fisher to prioritize her spending, saving, and investment strategies, ultimately contributing to the growth of her net worth.

For instance, if Isla Fisher has a financial goal of retiring early, she may choose to allocate a portion of her income towards retirement savings and investments that align with her risk tolerance and time horizon. This proactive approach to financial planning increases the likelihood of achieving her desired financial outcome and maximizing her net worth in the long run.

Understanding the connection between financial goals and net worth empowers Isla Fisher to make informed choices that support her financial objectives. By setting realistic goals, regularly reviewing progress, and adjusting strategies as needed, she can effectively manage her finances and work towards building a secure financial future.

In exploring Isla Fisher Net Worth How Much Is Fisher, this article has illuminated the multifaceted nature of net worth and its significance in financial well-being. Key insights include the understanding of assets, liabilities, income, expenses, investments, savings, debt, cash flow, and financial goals. These elements are interconnected and play a crucial role in determining an individual's financial health and overall wealth.

Firstly, assets represent valuable possessions and resources that contribute to net worth, while liabilities encompass financial obligations that reduce it. Income and expenses reflect the inflow and outflow of funds, impacting cash flow and financial stability. Investments and savings are essential for wealth accumulation and future financial security, while debt management is crucial for maintaining financial flexibility.

Ultimately, understanding the concept of "Isla Fisher Net Worth How Much Is Fisher" empowers individuals to make informed financial decisions, plan for the future, and achieve their financial aspirations. By assessing their financial position and setting clear goals, they can effectively manage their resources, build wealth, and secure their long-term financial well-being.