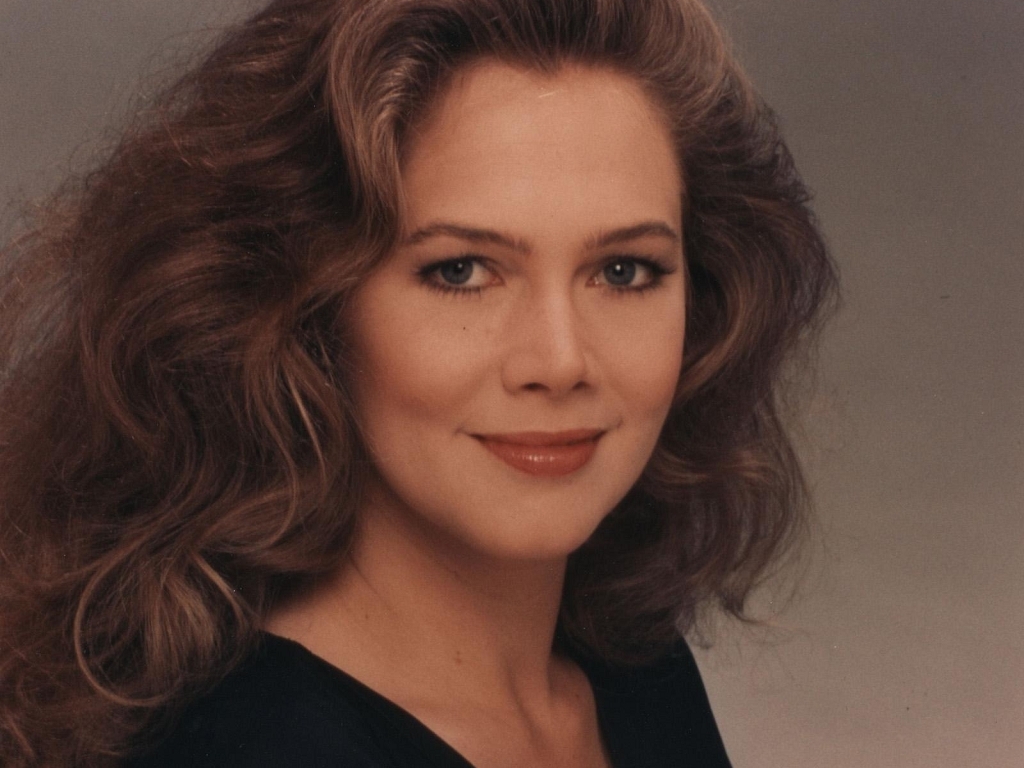

Kathleen Turner Net Worth: Uncovering The Fortune Of An Icon

Kathleen Turner Net Worth, a financial metric representing the estimated total value of the American actress' assets and liabilities, provides insights into her career success and financial status. For instance, as of 2023, Kathleen Turner's net worth is estimated to be around $25 million, illustrating her financial stability.

Understanding the net worth of high-profile individuals is not merely a matter of curiosity. It offers insights into their financial savvy, investment strategies, and overall financial well-being, which can inspire and inform others. Historically, the concept of net worth emerged as a key financial indicator, widely used by economists, investors, and businesses to assess financial health and make informed decisions.

This article delves into the details of Kathleen Turner's net worth, exploring its contributing factors, financial implications, and how it relates to her professional achievements. We will examine the sources of her wealth, her investments, and the impact of her financial decisions on her overall success. By doing so, we aim to provide a nuanced understanding of Kathleen Turner's financial journey and its implications for financial literacy and wealth management.

Read also:Chiara Mazzola Nude The Truth Behind The Clickbait

Kathleen Turner Net Worth

Kathleen Turner's net worth, a significant indicator of her financial well-being, encompasses various essential aspects that provide valuable insights into her career achievements and financial management strategies.

- Assets: Properties, investments, and valuable possessions.

- Liabilities: Debts, loans, and financial obligations.

- Income: Earnings from acting, endorsements, and other ventures.

- Expenses: Costs associated with maintaining her lifestyle and financial commitments.

- Investments: Strategies employed to grow her wealth.

- Taxation: Financial contributions to the government.

- Financial Planning: Management of her finances to secure her financial future.

- Estate Planning: Arrangements for the distribution of her assets after her passing.

- Charitable Contributions: Support for philanthropic causes.

- Business Ventures: Entrepreneurial endeavors beyond acting.

These aspects collectively contribute to Kathleen Turner's overall net worth and reflect her financial acumen, investment decisions, and charitable inclinations. Understanding these aspects provides a comprehensive view of her financial journey and its implications for personal wealth management.

Assets

Assets, encompassing properties, investments, and valuable possessions, play a pivotal role in determining Kathleen Turner's net worth. Properties, such as her real estate holdings, represent a significant portion of her assets, providing both financial security and potential for appreciation. Investments, including stocks, bonds, and mutual funds, contribute to her net worth through capital gains and dividends. Valuable possessions, such as jewelry, artwork, and collectibles, while not as liquid as other assets, also add to her overall wealth.

The relationship between assets and net worth is directly proportional. As Kathleen Turner acquires more assets, her net worth increases, reflecting her financial growth. The value of her assets fluctuates over time, influenced by market conditions and economic factors. However, historically, a well-diversified portfolio of assets has been shown to yield positive returns over the long term, contributing to the growth of her net worth.

Understanding the connection between assets and net worth is crucial for financial planning and wealth management. By investing in a mix of assets that align with her risk tolerance and financial goals, Kathleen Turner can potentially maximize her net worth over time. Additionally, strategic management of assets, such as optimizing real estate investments or rebalancing her investment portfolio, can further enhance her financial well-being.

In summary, assets are a critical component of Kathleen Turner's net worth, directly impacting its value. Her ability to acquire, manage, and grow her assets has been instrumental in her financial success. This understanding highlights the importance of asset management and diversification for individuals seeking to build and preserve their wealth.

Read also:Haesicks Nude Leaks The Truth Behind The Scandal And What You Need To Know

Liabilities

Liabilities, encompassing debts, loans, and financial obligations, represent a crucial component of Kathleen Turner's net worth. Unlike assets, which contribute positively to her net worth, liabilities have a negative impact. Debts, such as mortgages, personal loans, and credit card balances, reduce her net worth. Loans, such as those taken out for business ventures or investments, also contribute to her liabilities. Financial obligations, such as taxes and legal settlements, further diminish her net worth.

The relationship between liabilities and net worth is inversely proportional. As Kathleen Turner incurs more liabilities, her net worth decreases, reflecting her financial commitments. Managing liabilities effectively is essential for maintaining a healthy financial position. By reducing debt, fulfilling financial obligations, and negotiating favorable loan terms, she can minimize the impact of liabilities on her net worth.

Understanding the connection between liabilities and net worth is critical for financial planning and wealth management. By carefully considering the impact of liabilities on her overall financial picture, Kathleen Turner can make informed decisions about borrowing, debt repayment, and financial obligations. This understanding also highlights the importance of responsible financial management and the potential consequences of excessive debt.

In summary, liabilities are a significant factor in determining Kathleen Turner's net worth. Her ability to manage liabilities effectively, reduce debt, and fulfill financial obligations is crucial for maintaining a strong financial position. This understanding underscores the importance of prudent financial decision-making and the potential challenges associated with excessive liabilities.

Income

Income, derived from various sources such as acting, endorsements, and other ventures, plays a pivotal role in shaping Kathleen Turner's net worth. Her acting career, spanning decades, has been her primary source of income, with notable roles in films like "Body Heat," "Romancing the Stone," and "Peggy Sue Got Married." Endorsements and other ventures, such as book deals and public appearances, have further contributed to her income stream.

The relationship between income and net worth is directly proportional. As Kathleen Turner earns more income, her net worth increases. This is because income is added to her assets, which are then used to calculate her net worth. The consistency and growth of her income have been key factors in her financial success.

Understanding the connection between income and net worth is crucial for financial planning and wealth management. By maximizing her income through successful acting projects and strategic endorsements, Kathleen Turner has been able to accumulate wealth and secure her financial future. Additionally, managing her expenses and making wise investment decisions have allowed her to grow her net worth over time.

Expenses

Expenses, encompassing costs associated with maintaining Kathleen Turner's lifestyle and financial commitments, play a crucial role in shaping her net worth. These expenses can be categorized into various types, including living expenses, such as housing, food, and transportation; personal expenses, such as clothing, entertainment, and travel; and financial commitments, such as taxes, insurance, and charitable contributions. Understanding the relationship between expenses and net worth is essential for effective financial management.

The relationship between expenses and net worth is inversely proportional. As Kathleen Turner's expenses increase, her net worth decreases. This is because expenses reduce her disposable income, which is the amount of money available for saving and investment. Conversely, reducing expenses can increase her disposable income and contribute to her net worth growth. Managing expenses effectively is therefore critical for maintaining a healthy financial position.

Real-life examples of expenses within Kathleen Turner's net worth include property taxes, mortgage payments, utility bills, and insurance premiums. These expenses are necessary for maintaining her lifestyle and financial commitments. However, excessive or unnecessary expenses can negatively impact her net worth. By carefully monitoring her expenses and making informed decisions about her spending, Kathleen Turner can minimize their impact on her financial well-being.

The practical applications of understanding the connection between expenses and net worth extend beyond Kathleen Turner's personal finances. Individuals seeking to improve their financial health can benefit from tracking their expenses and identifying areas where they can reduce unnecessary spending. By curtailing expenses, they can increase their savings and investments, leading to long-term wealth accumulation.

In summary, expenses are a significant factor in determining Kathleen Turner's net worth. Managing expenses effectively, reducing unnecessary spending, and making wise financial decisions are crucial for maintaining a strong financial position. The principles of expense management are applicable to individuals of all income levels and can help them achieve their financial goals.

Investments

Within the realm of "Kathleen Turner Net Worth," investments play a pivotal role in augmenting her overall financial status. Turner has employed a multifaceted approach to investing, encompassing various strategies and asset classes to grow her wealth over time.

- Real Estate: Turner has invested in a portfolio of properties, including residential and commercial real estate, generating rental income, capital appreciation, and potential tax benefits.

- Stocks and Bonds: Her investment portfolio includes a diversified mix of stocks and bonds, providing exposure to both equity and fixed-income markets, balancing risk and return.

- Private Equity: Turner has invested in private equity funds, which provide access to non-publicly traded companies with high growth potential and the possibility of substantial returns.

- Alternative Investments: To further diversify her portfolio, Turner has explored alternative investments such as hedge funds, commodities, and precious metals, seeking uncorrelated returns to traditional assets.

These investment strategies have contributed significantly to Kathleen Turner's net worth growth, showcasing her financial acumen and ability to navigate diverse markets. Her investments have provided a steady stream of income, capital gains, and the potential for long-term wealth appreciation. Turner's investment strategies serve as a testament to the importance of diversification, risk management, and the pursuit of growth opportunities in building and preserving wealth.

Taxation

Within the context of "Kathleen Turner Net Worth," taxation plays a crucial role in shaping her overall financial landscape. As a law-abiding citizen, Turner is obligated to fulfill her tax responsibilities, which impact her net worth and contribute to the broader functioning of society.

- Income Taxes: A substantial portion of Turner's income is directed towards income taxes, which vary based on her earnings and applicable tax brackets. These contributions support essential government services, including infrastructure, education, and healthcare.

- Property Taxes: Turner's real estate holdings are subject to property taxes, which help fund local services such as schools, libraries, and parks. These taxes are calculated based on the assessed value of her properties.

- Capital Gains Taxes: When Turner sells assets like stocks or real estate for a profit, she is liable to pay capital gains taxes. These taxes are levied on the difference between the purchase price and the sale price.

- Other Taxes: In addition to the aforementioned taxes, Turner may also be subject to other levies, such as sales tax on purchases, excise taxes on certain goods, and estate taxes upon the transfer of her wealth.

The impact of taxation on Kathleen Turner's net worth is multifaceted. While taxes reduce her disposable income, they also contribute to the collective well-being of society by providing funds for public services and infrastructure. Understanding her tax obligations and planning accordingly is essential for Turner to optimize her financial position and contribute to the broader economy.

Financial Planning

Financial planning is a crucial aspect of "Kathleen Turner Net Worth" as it encompasses the management of her finances to ensure long-term financial security and well-being. Through meticulous planning and informed decisions, Kathleen Turner has charted a course to safeguard her financial future, allowing her to maintain her lifestyle, pursue her passions, and leave a lasting legacy.

- Investment Strategy: Turner has implemented a diversified investment strategy that aligns with her risk tolerance and financial goals. Her portfolio includes a mix of stocks, bonds, real estate, and alternative investments, providing a balance between growth potential and stability.

- Retirement Planning: As a seasoned actress, Turner has planned diligently for her retirement years. She has contributed to retirement accounts, such as 401(k)s and IRAs, ensuring a steady income stream in her golden years.

- Estate Planning: Turner has established an estate plan that outlines the distribution of her assets after her passing. By creating a will and trust, she can control how her wealth is managed and distributed to her beneficiaries.

- Risk Management: Turner understands the importance of risk management and has implemented measures to protect her financial well-being. She has adequate insurance coverage, including health, life, and disability insurance, to mitigate potential financial setbacks.

Kathleen Turner's financial planning serves as a testament to her foresight and commitment to securing her financial future. By embracing a comprehensive approach to managing her finances, she has laid the groundwork for sustained wealth and peace of mind, both for herself and her loved ones.

Estate Planning

Estate planning plays a pivotal role in safeguarding Kathleen Turner's net worth and ensuring her legacy. Through careful arrangements for the distribution of her assets after her passing, Turner can exert control over the management and distribution of her wealth, minimizing potential conflicts and ensuring her wishes are honored. Estate planning serves as a critical component of Turner's overall financial strategy, complementing her investments, tax planning, and other wealth management endeavors.

Real-life examples within Kathleen Turner's net worth illustrate the significance of estate planning. Turner has reportedly established a will and trust, legal documents that outline her specific instructions for asset distribution and the appointment of an executor to oversee her estate. By doing so, she has taken proactive steps to ensure her assets are managed according to her wishes, avoiding potential legal disputes or mismanagement after her passing. Furthermore, Turner's estate plan likely includes provisions for charitable giving, allowing her to support causes close to her heart and create a lasting impact beyond her lifetime.

The practical applications of understanding the connection between estate planning and Kathleen Turner's net worth extend not only to her personal legacy but also to the broader implications for wealth management. Estate planning provides individuals with the power to shape the distribution of their assets, minimizing tax burdens and ensuring their wealth is preserved for future generations. By engaging in estate planning, Turner has demonstrated her foresight and commitment to responsible wealth management, setting an example for others to follow.

In summary, estate planning is an integral aspect of Kathleen Turner's net worth, allowing her to control the distribution of her assets after her passing. Through careful planning and the establishment of legal documents such as wills and trusts, Turner has taken proactive steps to safeguard her legacy, minimize potential conflicts, and ensure her wishes are honored. The practical applications of estate planning extend beyond personal legacy, emphasizing its importance in responsible wealth management and the preservation of wealth for future generations.

Charitable Contributions

Charitable contributions play a significant role in shaping Kathleen Turner's net worth and reflecting her values and commitment to giving back to society. Turner has generously supported various philanthropic causes throughout her career, making a meaningful impact on organizations and communities. Her charitable contributions extend beyond financial donations, often involving her time and active participation in advocacy and awareness campaigns.

The connection between charitable contributions and Kathleen Turner's net worth is multifaceted. Firstly, her philanthropic efforts demonstrate her commitment to social responsibility and her belief in using her platform and resources to make a positive difference in the world. Secondly, charitable contributions can provide tax benefits, allowing Turner to reduce her tax liability while supporting causes she cares about. Additionally, her involvement in charitable work can enhance her public image and reputation, potentially leading to increased opportunities and partnerships.

Real-life examples of Kathleen Turner's charitable contributions include her support for organizations such as the American Cancer Society and the Human Rights Campaign. She has donated significant funds to cancer research and LGBTQ+ rights advocacy, aligning with her personal experiences and beliefs. Turner has also dedicated her time to visiting cancer patients, participating in fundraising events, and speaking out on behalf of important social causes. Her commitment to philanthropy extends beyond monetary donations, showcasing her genuine desire to make a meaningful impact.

Understanding the connection between charitable contributions and Kathleen Turner's net worth highlights the importance of philanthropy in wealth management. By supporting charitable causes, Turner not only fulfills her personal values but also contributes to the well-being of society. Her example inspires others to consider the role of philanthropy in their own financial planning and to use their resources to make a positive impact on the world.

Business Ventures

The entrepreneurial ventures that Kathleen Turner has pursued beyond her acting career have significantly contributed to her overall net worth and financial well-being. Turner has demonstrated a keen business acumen by investing in various ventures, leveraging her fame and industry knowledge to generate additional income streams and diversify her wealth portfolio.

One notable example of Turner's business ventures is her involvement in the production of the Broadway play, "High." Turner served as an executive producer for the play, which enjoyed a successful run and garnered critical acclaim. Her involvement in the production not only showcased her passion for theater but also provided her with a lucrative return on investment. Additionally, Turner has invested in real estate, owning several properties in prime locations. These investments have provided her with a steady stream of passive income through rent and potential capital appreciation.

Understanding the connection between Kathleen Turner's business ventures and her net worth highlights the importance of diversification and strategic financial planning. By venturing beyond her primary source of income as an actress, Turner has created a more robust financial foundation, reducing her reliance on a single income stream and mitigating financial risks. Her business ventures have not only contributed to her wealth accumulation but have also provided her with greater financial security and independence.

In summary, Kathleen Turner's business ventures have played a pivotal role in shaping her net worth. Her entrepreneurial spirit and savvy investments have allowed her to diversify her income sources, create passive income streams, and build a more robust financial portfolio. This understanding emphasizes the importance of exploring entrepreneurial opportunities and making strategic financial decisions to achieve long-term wealth and financial well-being.

This comprehensive exploration of "Kathleen Turner Net Worth" has illuminated the multifaceted factors that have contributed to her remarkable financial success. Throughout her career, Turner has consistently demonstrated a savvy approach to wealth management, encompassing strategic investments, entrepreneurial ventures, and a commitment to philanthropy. Her ability to diversify her income streams, minimize financial risks, and align her financial decisions with her values has been instrumental in building and preserving her net worth.

Three key points that emerge from this analysis are:

- The importance of a diversified investment portfolio, encompassing a mix of assets and asset classes, to mitigate risk and maximize growth potential.

- The potential benefits of exploring entrepreneurial opportunities beyond primary income sources, providing additional income streams and enhancing financial resilience.

- The role of philanthropy in wealth management, not only as a means of giving back but also as a vehicle for social impact and tax optimization.

In conclusion, Kathleen Turner's net worth serves as a testament to the power of financial literacy, strategic planning, and a commitment to making a difference. Her financial journey offers valuable lessons for individuals seeking to achieve financial well-being and create a lasting legacy.