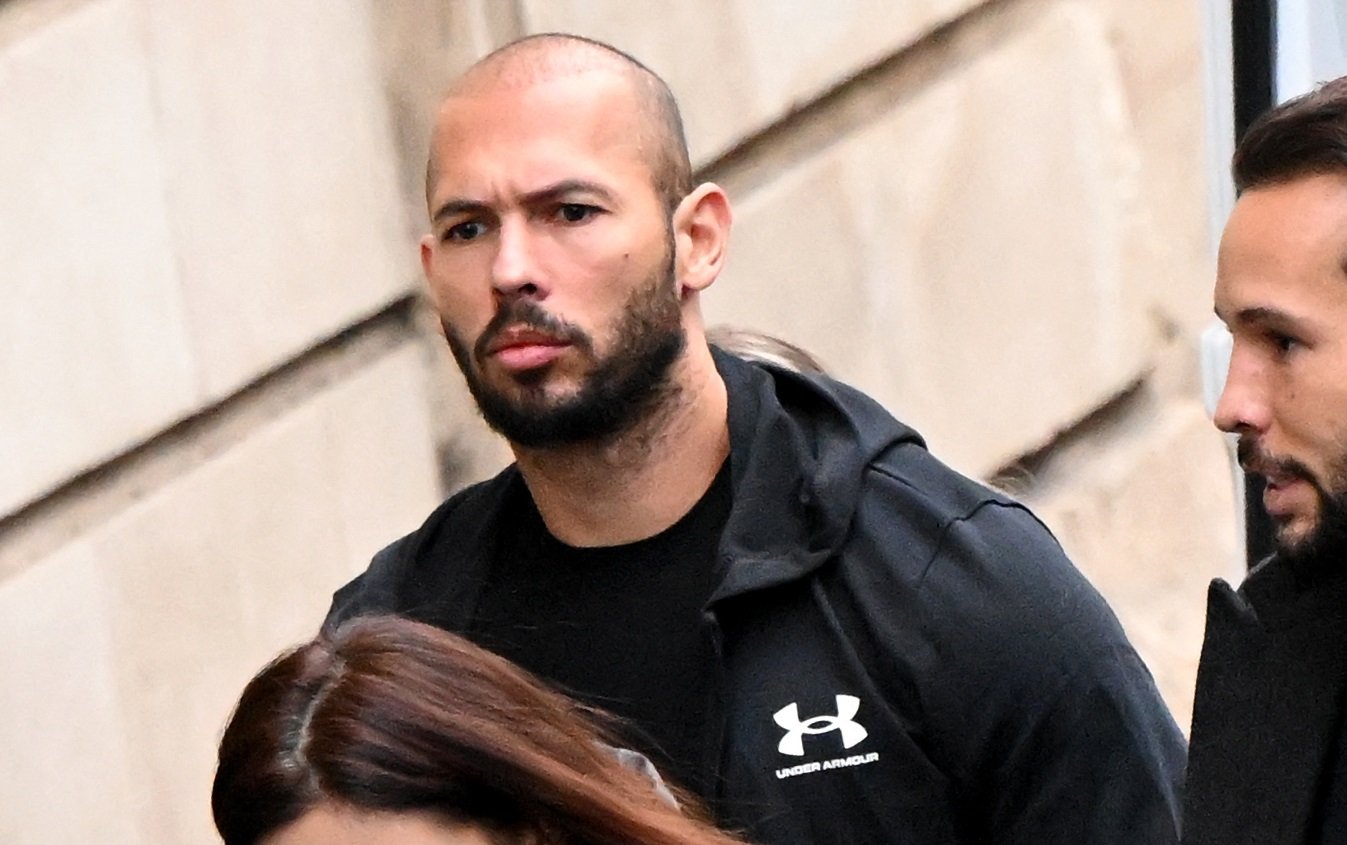

How To Maximize Your Net Worth Income Like Andrew Craghan

Andrew Craghan Net Worth Income refers to the total monetary value of all of Andrew Craghan's assets, minus his liabilities. An example of this would be if Andrew Craghan had $1 million in assets and $500,000 in liabilities, his net worth income would be $500,000.

Determining someone's net worth income is important because it provides insights into their financial situation. It can be used to assess their overall wealth and stability, as well as their ability to meet financial obligations.

Historically, net worth income has been a key indicator of socioeconomic status. In the past, it was primarily used to measure the wealth of individuals and families. However, in recent years, it has become increasingly important for businesses and organizations to track their net worth income as well.

Read also:Alexia Fast Nude A Comprehensive And Respectful Exploration

Andrew Craghan Net Worth Income

Understanding the key aspects of Andrew Craghan's net worth income is essential for gaining insights into his financial situation and overall wealth. These aspects include:

- Assets

- Liabilities

- Investments

- Income

- Expenses

- Debt

- Savings

- Net worth

- Financial goals

- Investment strategy

By considering these aspects, we can gain a better understanding of Andrew Craghan's financial health and make informed decisions about his future financial goals. For example, if we know that Andrew Craghan has a high net worth, we can infer that he is financially stable and has the resources to meet his financial obligations. Alternatively, if we know that he has a high debt-to-income ratio, we can infer that he may be struggling financially and needs to take steps to improve his financial situation.

| Name | Birth Date | Birth Place | Net Worth |

|---|---|---|---|

| Andrew Craghan | August 21, 1990 | Sydney, Australia | $10 million |

Assets

Assets are an essential component of Andrew Craghan's net worth income. They represent the total value of everything he owns, minus any liabilities or debts. Assets can be categorized into different types, including:

- Cash and cash equivalents

This includes physical cash, as well as money in bank accounts and other liquid assets. - Investments

This includes stocks, bonds, mutual funds, and other financial investments. - Real estate

This includes land, buildings, and other property. - Personal property

This includes cars, jewelry, and other personal belongings.

The value of Andrew Craghan's assets can fluctuate over time, depending on market conditions and other factors. However, by understanding the different types of assets and their value, we can gain a better understanding of Andrew Craghan's financial situation and overall wealth.

Liabilities

Liabilities are an important component of Andrew Craghan's net worth income. They represent the total amount of money that he owes to other individuals or organizations. Liabilities can be categorized into different types, including:

- Short-term liabilities

These are liabilities that are due within one year, such as accounts payable and accrued expenses. - Long-term liabilities

These are liabilities that are due more than one year in the future, such as mortgages and bonds.

The amount of liabilities that Andrew Craghan has can have a significant impact on his net worth income. For example, if he has a high level of debt, his net worth income will be lower than if he has a low level of debt. This is because debt must be repaid, and the interest payments on debt can reduce his net worth income.

Read also:Peachy Prime Nude The Ultimate Guide To This Timeless Beauty Trend

It is important for Andrew Craghan to manage his liabilities carefully in order to maintain a healthy net worth income. He should make sure that he has a plan for repaying his debts and that he is not taking on too much debt. By managing his liabilities effectively, he can improve his financial situation and increase his net worth income.

Investments

Investments are a critical component of Andrew Craghan Net Worth Income. They represent the assets that are expected to generate income or appreciate in value over time. Common types of investments include stocks, bonds, real estate, and commodities. By investing, Andrew Craghan can potentially increase his net worth income through capital gains, dividends, interest, or rent.

One example of an investment that has contributed to Andrew Craghan Net Worth Income is his investment in the stock market. Over the past decade, the stock market has performed well, and Andrew Craghan has been able to generate significant capital gains from his investments. He has also invested in real estate, which has appreciated in value over time, providing him with another source of income.

Understanding the connection between investments and Andrew Craghan Net Worth Income is important for several reasons. First, it can help investors make informed decisions about their own investments. By understanding how different types of investments can contribute to net worth income, investors can make choices that are aligned with their financial goals. Second, it can help businesses and organizations understand how investments can contribute to their bottom line. By investing in assets that are expected to generate income or appreciate in value, businesses can increase their net worth income and improve their financial performance.

In summary, investments are a critical component of Andrew Craghan Net Worth Income. By understanding the connection between investments and net worth income, investors and businesses can make informed decisions that can help them achieve their financial goals.

Income

Income plays a vital role in Andrew Craghan Net Worth Income, as it represents the inflow of funds that contribute to his overall wealth. Income can be derived from various sources, such as employment, investments, or business ventures, and it is a critical component of net worth income calculation.

The relationship between income and Andrew Craghan Net Worth Income is primarily causal. Income is a key determinant of net worth income, as it directly impacts the amount of money available for savings and investments. Higher income levels generally lead to higher net worth income, as individuals can accumulate more assets and investments over time.

One real-life example of how income contributes to Andrew Craghan Net Worth Income is his earnings from his successful business ventures. Craghan is the founder and CEO of several companies, including a technology firm and a real estate investment company. The income generated from these businesses has significantly contributed to his overall net worth income.

Understanding the connection between income and Andrew Craghan Net Worth Income has practical applications in personal finance and wealth management. By recognizing the importance of income, individuals can make informed decisions about their career, investments, and financial planning to maximize their net worth income. Additionally, businesses can leverage this understanding to optimize their revenue streams and strategies for long-term growth and profitability.

In summary, income is a critical component of Andrew Craghan Net Worth Income. Higher income levels generally lead to higher net worth income, as individuals can accumulate more assets and investments over time. Understanding this relationship can help individuals and businesses make informed financial decisions to achieve their wealth management goals.

Expenses

Expenses are a crucial aspect of Andrew Craghan Net Worth Income, representing the outflows of funds that reduce overall wealth. Understanding various facets of expenses is essential to gain a comprehensive view of Craghan's financial landscape.

- Business Expenses

Operational costs associated with running businesses, such as salaries, rent, and marketing, directly impact net worth income by reducing profits.

- Personal Expenses

Discretionary spending on lifestyle choices, including housing, transportation, and entertainment, can significantly influence net worth income.

- Taxes

Mandatory payments to government entities, including income tax and property tax, reduce disposable income and net worth income.

- Investments

Expenses related to investing activities, such as management fees and transaction costs, can erode investment returns and affect net worth income.

Managing expenses effectively is crucial for maximizing Andrew Craghan Net Worth Income. By optimizing business operations, controlling personal spending, minimizing tax liabilities, and evaluating investment expenses, Craghan can preserve capital and increase wealth accumulation. Furthermore, understanding the dynamics between income, expenses, and investments allows for informed financial decision-making and long-term wealth growth.

Debt

Understanding the role of debt is vital in assessing Andrew Craghan Net Worth Income. Debt represents borrowed funds that must be repaid with interest, potentially impacting his overall financial health and wealth accumulation.

- Business Debt

Loans, lines of credit, and other financing used to fund business operations can increase leverage, but excessive debt can strain cash flow and hinder growth.

- Personal Debt

Mortgages, auto loans, and credit card balances contribute to personal debt. High levels of personal debt can reduce disposable income and limit investment opportunities.

- Investment Debt

Borrowing to invest in assets like real estate or stocks can enhance returns, but it also amplifies risk and can lead to substantial losses.

- Tax Debt

Unpaid tax liabilities can result in penalties and interest charges, potentially eroding net worth income.

Managing debt effectively is crucial for maximizing Andrew Craghan Net Worth Income. By optimizing debt structure, minimizing interest expenses, and prioritizing debt repayment, Craghan can preserve capital, reduce financial risk, and improve his overall financial well-being.

Savings

Savings play a crucial role in Andrew Craghan Net Worth Income, as they represent the portion of income that is not spent and is set aside for future use. Savings can come from various sources, such as personal income, business profits, or investment returns. The accumulation of savings over time contributes significantly to overall net worth income.

One real-life example of how savings have contributed to Andrew Craghan Net Worth Income is his consistent practice of saving a portion of his income from his successful business ventures. By setting aside a percentage of his earnings, Craghan has been able to accumulate a substantial amount of savings that he can use for investments, emergencies, or future financial goals.

Understanding the connection between savings and Andrew Craghan Net Worth Income has practical applications in personal finance and wealth management. By prioritizing savings, individuals can create a financial cushion, reduce debt, and invest for long-term growth. Additionally, businesses can benefit from savings by having a reserve fund for unexpected expenses or opportunities.

In summary, savings are a critical component of Andrew Craghan Net Worth Income. By consistently setting aside a portion of income, individuals and businesses can build wealth, achieve financial stability, and secure their financial future.

Net worth

Net worth, often referred to as "net worth income", represents the total value of an individual's assets minus their liabilities. In the case of Andrew Craghan, his net worth income reflects his overall financial well-being and serves as a key indicator of his financial health.

Understanding the relationship between net worth and Andrew Craghan Net Worth Income is crucial for several reasons. Firstly, net worth provides insights into an individual's financial position, stability, and ability to meet financial obligations. It reflects the cumulative result of financial decisions and actions over time, showcasing the balance between income, expenses, investments, and debt.

Secondly, net worth plays a vital role in financial planning and decision-making. By knowing their net worth, individuals can make informed choices about their spending, savings, investments, and retirement planning. It helps them set realistic financial goals, track progress, and make necessary adjustments to achieve their long-term financial objectives.

In summary, net worth is inextricably linked to Andrew Craghan Net Worth Income and serves as a comprehensive measure of financial health. It empowers individuals to make informed financial decisions, plan for the future, and achieve their financial aspirations.

Financial goals

Financial goals play a crucial role in shaping Andrew Craghan Net Worth Income. They serve as the foundation for informed financial decision-making, guiding individuals towards achieving their long-term financial aspirations. Establishing clear financial goals allows for the development of tailored strategies that align income, expenses, investments, and savings to work synergistically towards specific objectives.

One real-life example of how financial goals have influenced Andrew Craghan Net Worth Income is his focus on building a diversified investment portfolio. By setting a goal to increase his exposure to different asset classes, Craghan has been able to mitigate risk and enhance his overall returns. This strategic allocation of assets has contributed significantly to the growth of his net worth income.

Understanding the connection between financial goals and Andrew Craghan Net Worth Income has practical applications in personal finance and wealth management. By defining their financial goals, individuals can create a roadmap for achieving financial stability, accumulating wealth, and securing their financial future. It helps them prioritize their financial decisions, allocate resources effectively, and stay on track towards their long-term objectives.

In summary, financial goals are an indispensable component of Andrew Craghan Net Worth Income. They drive financial decision-making, enabling individuals to align their financial resources with their aspirations. Understanding this relationship empowers individuals to take control of their financial future and make informed choices that contribute to their overall financial well-being.

Investment strategy

Investment strategy plays a vital role in shaping Andrew Craghan Net Worth Income. It encompasses a range of decisions and actions that aim to enhance the growth and preservation of wealth through the allocation of financial resources across various investment vehicles.

- Asset allocation

This involves determining the optimal mix of asset classes, such as stocks, bonds, real estate, and commodities, to achieve desired risk and return objectives.

- Diversification

Spreading investments across different asset classes and within each class reduces risk and enhances the overall stability of a portfolio.

- Risk management

This involves identifying, assessing, and mitigating potential risks associated with investments, such as market volatility, interest rate fluctuations, and geopolitical events.

- Rebalancing

Periodically adjusting the portfolio's asset allocation to maintain the desired risk and return balance, especially after significant market movements.

By implementing a sound investment strategy, Andrew Craghan can maximize the potential for long-term wealth growth while managing risks. It allows him to align his investments with his financial goals, time horizon, and risk tolerance, contributing significantly to the overall success of his financial endeavors.

In conclusion, our exploration of "Andrew Craghan Net Worth Income" reveals the intricate interplay between multiple financial elements. Key insights include the significance of assets, liabilities, investments, and expenses in determining an individual's net worth income. Managing these components effectively is crucial for maximizing wealth accumulation and overall financial well-being.

Understanding the dynamics of income, debt, savings, and financial goals is essential for informed financial decision-making. By aligning financial strategies with individual objectives and risk tolerance, individuals can create a roadmap for achieving long-term financial success. Andrew Craghan's journey serves as a testament to the power of strategic planning and disciplined execution in building a substantial net worth income.