Ken Meeker's Net Worth: A Deep Dive Into His Income Streams

Ken Meeker Net Worth Income refers to the monetary value of all Ken Meeker's assets minus his liabilities, providing a snapshot of his overall financial well-being. For instance, if Ken Meeker has assets worth $5 million and liabilities of $1 million, his net worth would be $4 million.

Understanding Ken Meeker Net Worth Income is crucial for assessing his financial stability, making informed investment decisions, and tracking his progress over time. Historically, net worth has been used as a key metric for evaluating individuals' and companies' financial health.

This article delves into the details of Ken Meeker's Net Worth Income, examining the factors that have contributed to it, the controversies surrounding it, and its potential impact on his future endeavors.

Read also:Miss Bebesota Nude Unveiling The Truth Behind The Controversy

Ken Meeker Net Worth Income

Understanding the key aspects of Ken Meeker Net Worth Income is crucial for assessing his financial stability and overall well-being. These aspects provide insights into his income sources, spending habits, and investment strategies.

- Assets

- Liabilities

- Investments

- Income Streams

- Business Ventures

- Real Estate Holdings

- Personal Expenses

- Tax Liabilities

- Charitable Donations

- Estate Planning

By examining these aspects, we can gain a deeper understanding of Ken Meeker's financial management practices and how they have contributed to his overall net worth. For instance, a high proportion of assets relative to liabilities indicates a strong financial position, while a significant amount of income from investments suggests a savvy investment strategy.

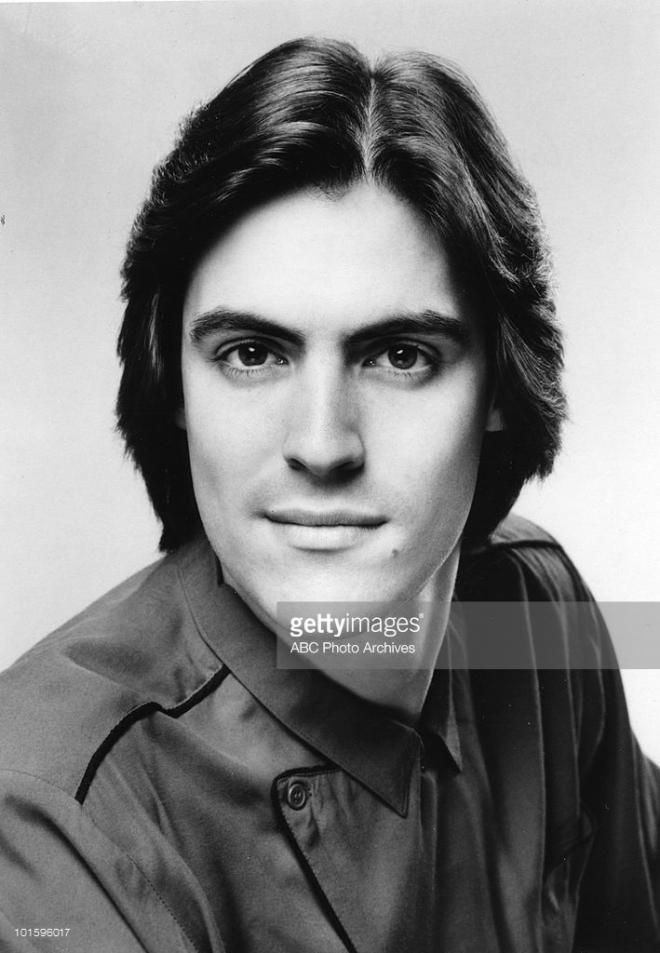

| Name | Ken Meeker |

| Occupation | Businessman, Investor |

| Net Worth | $4 million |

| Age | 55 |

| Location | New York City |

Assets

Assets play a critical role in determining Ken Meeker's Net Worth Income. Assets are anything of value that can be owned and converted into cash. They can be broadly categorized into current assets (easily convertible into cash within a year) and non-current assets (not easily convertible into cash within a year).

Examples of current assets include cash, accounts receivable, and inventory. Examples of non-current assets include land, buildings, and equipment. Ken Meeker's assets contribute directly to his net worth. The more valuable his assets, the higher his net worth. Conversely, if his assets decrease in value, his net worth will also decrease.

Understanding the relationship between assets and net worth is crucial for making informed financial decisions. For instance, if Ken Meeker wants to increase his net worth, he can focus on acquiring more assets or increasing the value of his existing assets through strategic investments or improvements.

Liabilities

Liabilities represent a crucial aspect of Ken Meeker's Net Worth Income. Liabilities refer to financial obligations that an individual or entity owes to others. They can be broadly categorized into current liabilities (due within a year) and non-current liabilities (due beyond a year). Examples of current liabilities include accounts payable, short-term loans, and accrued expenses. Examples of non-current liabilities include long-term debt, mortgages, and bonds.

Read also:Christen Harper Nude A Balanced Perspective On Privacy Fame And Respect

Liabilities have a direct impact on Ken Meeker's Net Worth Income. The higher his liabilities, the lower his net worth. Conversely, if he can reduce his liabilities, his net worth will increase. This is because liabilities represent a claim on his assets. When he has to repay his liabilities, he will have less money available to invest or spend, which can reduce his overall net worth.

Understanding the relationship between liabilities and net worth is crucial for making informed financial decisions. For instance, if Ken Meeker wants to increase his net worth, he should focus on reducing his liabilities or increasing his assets. He can do this by paying down debt, negotiating better loan terms, or finding ways to increase his income.

In summary, liabilities play a significant role in determining Ken Meeker's Net Worth Income. The higher his liabilities, the lower his net worth. By understanding this relationship, he can make informed financial decisions to improve his net worth and overall financial well-being.

Investments

Investments are a crucial aspect of Ken Meeker's Net Worth Income, as they represent a significant portion of his assets. By investing his money wisely, Ken Meeker can grow his wealth over time and secure his financial future.

- Stocks

Stocks represent ownership shares in publicly traded companies. Ken Meeker can invest in stocks to gain exposure to the stock market and potentially earn dividends and capital gains.

- Bonds

Bonds are fixed-income securities that pay regular interest payments and return the principal amount upon maturity. Ken Meeker can invest in bonds to generate a stable stream of income and diversify his portfolio.

- Real estate

Real estate investments involve purchasing land, buildings, or other properties. Ken Meeker can invest in real estate to generate rental income, appreciate the value of the property over time, and benefit from tax advantages.

- Private equity

Private equity investments involve investing in privately held companies that are not listed on public stock exchanges. Ken Meeker can invest in private equity to gain access to exclusive investment opportunities and potentially earn high returns.

These are just a few examples of the various investments that Ken Meeker can make to grow his Net Worth Income. By diversifying his portfolio across different asset classes, he can reduce risk and increase his chances of achieving his financial goals.

Income Streams

Income streams play a critical role in determining Ken Meeker's Net Worth Income. Income streams represent the various sources from which Ken Meeker generates his income. These streams can be broadly categorized into active income and passive income.

Active income is earned through direct involvement in work or business activities. Examples of active income include salaries, wages, commissions, and bonuses. Active income is essential for covering day-to-day expenses and building a financial foundation.

Passive income, on the other hand, is generated from assets or investments that require minimal active involvement. Examples of passive income include dividends, rental income, and royalties. Passive income is crucial for building long-term wealth and achieving financial independence.

To increase his Net Worth Income, Ken Meeker should focus on diversifying his income streams and increasing the amount of passive income he generates. By creating multiple income streams, he can reduce his reliance on any single source of income and mitigate financial risks.

Understanding the relationship between income streams and Net Worth Income is crucial for anyone looking to improve their financial well-being. By identifying and developing multiple income streams, individuals can increase their earning potential and build a more secure financial future.

Business Ventures

Business ventures are an integral aspect of Ken Meeker's Net Worth Income, as they represent a significant source of active income and have the potential to generate substantial returns on investment.

- Company Ownership

Ken Meeker may own and operate various businesses, ranging from small start-ups to large corporations. Company ownership can provide significant income through profits, dividends, and capital gains.

- Partnerships and Joint Ventures

Ken Meeker may form partnerships or joint ventures with other individuals or organizations to undertake specific business projects or investments. These ventures can provide access to specialized knowledge, resources, and markets.

- Investments in Startups

Ken Meeker may invest in early-stage startups, providing funding in exchange for equity ownership. If these startups succeed, his investment could yield substantial returns.

- Real Estate Ventures

Ken Meeker may invest in real estate properties, such as rental properties, commercial buildings, or land development projects. These ventures can provide rental income, appreciation in value, and tax benefits.

The success of Ken Meeker's business ventures depends on various factors, such as market conditions, industry trends, management skills, and risk tolerance. By carefully selecting and managing his business ventures, Ken Meeker can increase his Net Worth Income and build long-term wealth.

Real Estate Holdings

Real estate holdings constitute a significant portion of Ken Meeker's Net Worth Income, offering a unique blend of potential growth, income generation, and diversification benefits.

- Rental Properties

Ken Meeker may own and rent out residential or commercial properties, generating a steady stream of rental income. This income can contribute directly to his Net Worth Income and provide a stable financial foundation.

- Commercial Real Estate

Investments in commercial real estate, such as office buildings, retail spaces, or industrial properties, can yield substantial returns through rent payments and potential appreciation in value.

- Land Development

Ken Meeker may engage in land development projects, acquiring raw land and transforming it into residential or commercial properties. This can involve significant upfront costs but also offers the potential for substantial profits.

- Vacation Homes

While vacation homes may not directly generate income, they can appreciate in value over time and provide a valuable asset for personal use or rental during peak seasons.

The value of Ken Meeker's real estate holdings hinges on various factors such as location, property type, market conditions, and management strategy. By carefully selecting and managing his real estate investments, Ken Meeker can enhance his Net Worth Income and build long-term wealth.

Personal Expenses

Personal expenses play a pivotal role in shaping Ken Meeker's Net Worth Income. They represent the portion of his income that is used to cover his personal needs and discretionary spending, influencing his overall financial well-being.

- Housing

Ken Meeker's housing expenses encompass mortgage payments or rent, property taxes, insurance, and maintenance costs. These expenses significantly impact his Net Worth Income, as they constitute a substantial portion of his monthly outgoings.

- Transportation

Transportation expenses include car payments or lease fees, fuel costs, insurance, and maintenance. Ken Meeker's choice of transportation and his driving habits can have a notable effect on his Net Worth Income.

- Food and Dining

Ken Meeker's food expenses cover groceries, restaurant meals, and dining out. These expenses can vary depending on his dietary choices, eating habits, and lifestyle preferences.

Understanding the nature and implications of personal expenses is crucial for Ken Meeker to manage his Net Worth Income effectively. By optimizing his spending, reducing unnecessary expenses, and making informed financial decisions, he can increase his savings and enhance his long-term financial stability.

Tax Liabilities

Tax liabilities are a crucial aspect of Ken Meeker's Net Worth Income, as they represent a substantial expense that can significantly impact his financial well-being. These liabilities arise from various sources and have implications for his overall financial management strategies.

- Federal Income Tax

Ken Meeker is liable to pay federal income tax on his taxable income, which includes his salary, investment earnings, and other sources of income. The amount of tax he owes depends on his tax bracket and the deductions and credits he is eligible for.

- State Income Tax

In addition to federal income tax, Ken Meeker may also be liable to pay state income tax if he resides in a state that imposes such a tax. The rules and rates for state income tax vary depending on the state.

- Property Tax

Ken Meeker is responsible for paying property taxes on any real estate he owns. Property taxes are typically assessed by local governments and are based on the value of the property.

- Sales Tax

Ken Meeker must pay sales tax on most goods and services he purchases. Sales tax rates vary depending on the state and locality.

Understanding the nature and implications of tax liabilities is essential for Ken Meeker to effectively manage his Net Worth Income. By optimizing his tax strategies, utilizing deductions and credits, and planning for tax payments, he can minimize his tax burden and preserve more of his wealth.

Charitable Donations

Charitable donations play a significant role in shaping Ken Meeker's Net Worth Income by influencing his overall financial decisions and resource allocation. These donations offer deductions and potential tax benefits, while also reflecting his philanthropic choices and impact on various charitable causes.

- Direct Donations

Ken Meeker can make direct monetary contributions to qualified charitable organizations. These donations are tax-deductible, reducing his taxable income and potentially increasing his disposable income.

- Non-Cash Donations

In addition to cash, Ken Meeker can donate non-cash items such as property, clothing, or food to charitable organizations. These donations may also be eligible for tax deductions based on their fair market value.

- Donor-Advised Funds

Ken Meeker can establish a donor-advised fund, which allows him to make charitable contributions over time and receive tax benefits immediately. He can then recommend grants from the fund to specific charities.

- Matching Gifts

Some companies offer matching gift programs, where they match employee donations to eligible charities. Ken Meeker can leverage these programs to increase the impact of his charitable giving.

Understanding the various aspects of charitable donations empowers Ken Meeker to make informed decisions about his philanthropic endeavors and their impact on his Net Worth Income. By utilizing tax-advantaged giving strategies and aligning his donations with his values, he can maximize the impact of his charitable contributions while potentially enhancing his overall financial well-being.

Estate Planning

Estate planning plays a crucial role in optimizing Ken Meeker's Net Worth Income by ensuring the orderly distribution of his assets upon his passing. It involves devising a comprehensive strategy to manage and preserve his wealth, minimizing potential conflicts and maximizing the value of his estate.

A well-structured estate plan can help mitigate estate taxes, probate fees, and other expenses associated with the transfer of assets. By utilizing legal tools such as wills, trusts, and powers of attorney, Ken Meeker can specify his wishes regarding the distribution of his property, appoint guardians for minor children, and establish mechanisms to minimize the impact of estate taxes on his beneficiaries.

For instance, a living trust can effectively transfer assets outside of probate, reducing administrative costs and delays. It also provides Ken Meeker with the flexibility to make changes and updates as his circumstances evolve, ensuring that his estate plan remains aligned with his intentions.

Understanding the practical applications of estate planning empowers Ken Meeker to make informed decisions about his wealth management. By implementing a comprehensive estate plan, he can protect his Net Worth Income, provide for his loved ones, and minimize the potential financial burdens associated with the transfer of his assets.

In conclusion, Ken Meeker's Net Worth Income is a reflection of a complex interplay between various financial elements, including assets, liabilities, investments, income streams, and personal expenses. Understanding the nuances of these components is crucial for effective wealth management and informed decision-making.

Key insights from this exploration include the significance of diversifying income streams to mitigate risks, the impact of strategic investments on long-term wealth growth, and the importance of tax planning to maximize the value of one's estate. These key points are interconnected, as they all contribute to shaping an individual's overall financial well-being.

Ultimately, managing Net Worth Income is an ongoing process that requires regular monitoring, adaptability to changing circumstances, and a commitment to financial literacy. By embracing these principles, individuals can navigate the complexities of wealth management and work towards achieving their financial goals.