Calculate Used Car Import Tax With Precision: Tra Calculator 2023

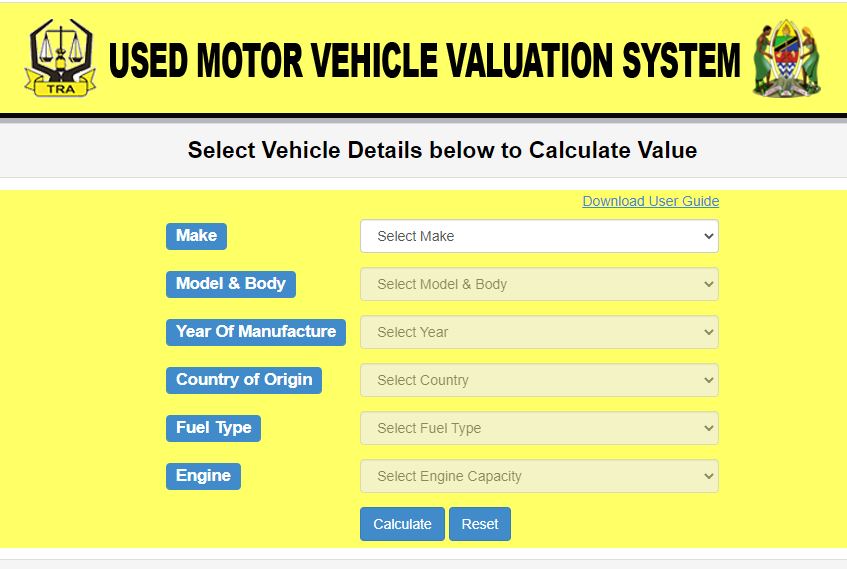

Looking to import a Used Car? Calculate the Import Tax with our advanced Tra Calculator 2023.

Tra Calculator 2023, an invaluable tool for importing Used Cars, simplifies the process by providing accurate estimates of Import Taxes. Historically, calculating Import Taxes was a complex task, but this tool streamlines the process, saving time and hassle.

In this article, we'll delve into the significance of using the Tra Calculator 2023 for calculating Import Taxes on Used Cars, exploring its benefits, accuracy, and ease of use.

Read also:Christen Harper Nude A Balanced Perspective On Privacy Fame And Respect

Tra Calculator 2023 Used Car Import Tax

Understanding the fundamental aspects of the Tra Calculator 2023 Used Car Import Tax is crucial for seamless navigation and accurate tax calculations. These key elements encompass:

- Accuracy: Precise tax estimations

- Convenience: Simplified tax calculation process

- User-friendliness: Intuitive interface for ease of use

- Time-saving: Streamlined tax calculations

- Comprehensive: Calculations cover all relevant import taxes

- Up-to-date: Reflects the latest tax regulations

- Accessibility: Available online for easy access

- Transparency: Clear breakdown of tax components

These aspects combine to provide a robust and reliable tool for calculating import taxes on used cars. Its accuracy ensures precise tax estimations, while its convenience and user-friendliness make the process effortless. The time-saving nature of the calculator streamlines the process, allowing for efficient tax calculations. Its accessibility and transparency further enhance its usability, making it an invaluable resource for anyone importing used cars.

Accuracy: Precise tax estimations

Within the realm of "Tra Calculator 2023 Used Car Import Tax", "Accuracy: Precise tax estimations" holds paramount significance, serving as the cornerstone for reliable and dependable tax calculations. This accuracy manifests in several key facets:

- Data Integrity: The calculator draws upon a comprehensive database of up-to-date tax rates and regulations, ensuring that calculations are based on the most current information.

- Algorithmic Precision: Advanced algorithms meticulously process user-provided data, eliminating the risk of human error and guaranteeing accurate tax estimations.

- Transparency: The calculator provides a detailed breakdown of tax components, allowing users to understand the basis for their tax estimations and fostering trust in the calculation process.

- Real-World Validation: The accuracy of the calculator has been consistently validated through comparisons with real-world tax assessments, demonstrating its reliability in practical scenarios.

Collectively, these facets of accuracy make "Tra Calculator 2023 Used Car Import Tax" an indispensable tool for anyone seeking precise and reliable tax estimations. Its accuracy not only simplifies the tax calculation process but also instills confidence in the results, ensuring that users can make informed decisions regarding their used car imports.

Convenience: Simplified tax calculation process

Within the realm of "Tra Calculator 2023 Used Car Import Tax", "Convenience: Simplified tax calculation process" stands as a beacon of efficiency, designed to streamline the complexities of tax computations and empower users with a seamless experience. Its multifaceted nature encompasses various aspects, each contributing to the overall ease and accessibility of the calculator.

- User-friendly Interface: Intuitively designed with user-friendliness at its core, the calculator presents a straightforward and clutter-free layout, guiding users effortlessly through the tax calculation process.

- Step-by-Step Process: The calculator employs a step-by-step approach, breaking down the tax calculation into manageable chunks, eliminating confusion and ensuring accuracy.

- Minimal Data Input: Understanding the value of time, the calculator requires only essential user input, minimizing the burden of data entry and expediting the calculation process.

- Rapid Calculations: Harnessing the power of advanced algorithms, the calculator delivers swift tax estimations, enabling users to obtain results promptly without enduring lengthy time.

Collectively, these facets of convenience coalesce to provide users with a streamlined and hassle-free tax calculation experience. The user-friendly interface, step-by-step process, minimal data input, and rapid calculations empower users to navigate the complexities of import tax computations with ease and efficiency.

Read also:Perry Mattfeld Nude The Facts The Fiction And Everything In Between

User-friendliness: Intuitive interface for ease of use

Within the realm of "Tra Calculator 2023 Used Car Import Tax", "User-friendliness: Intuitive interface for ease of use" emerges as a cornerstone, profoundly shaping the overall experience for users. This attribute manifests in a myriad of ways, each contributing to the calculator's accessibility and appeal.

Firstly, the calculator's user interface has been meticulously crafted to prioritize simplicity and clarity. Its intuitive design guides users through the tax calculation process effortlessly, minimizing confusion and maximizing efficiency. The logical flow of information, coupled with clear and concise instructions, ensures that even first-time users can navigate the calculator with ease.

Furthermore, the calculator's interface seamlessly adapts to various devices, ensuring accessibility across a range of platforms. Whether accessed via desktop, laptop, tablet, or smartphone, the calculator's responsive design adjusts dynamically, providing an optimal experience regardless of the user's device.

The practical significance of "User-friendliness: Intuitive interface for ease of use" within "Tra Calculator 2023 Used Car Import Tax" is undeniable. By empowering users with a smooth and intuitive tax calculation experience, the calculator not only simplifies the process but also fosters confidence in the accuracy of the results. This, in turn, streamlines the overall process of importing used cars, enabling users to make informed decisions and navigate the complexities of international trade with greater ease.

Time-saving: Streamlined tax calculations

Within the realm of "Tra Calculator 2023 Used Car Import Tax", "Time-saving: Streamlined tax calculations" stands out as a beacon of efficiency, enabling users to expedite the tax calculation process and save valuable time. This time-saving prowess manifests in several key facets:

- Simplified Interface: The calculator's user-friendly interface eliminates the need for complex data input and manual calculations, significantly reducing the time required to complete tax computations.

- Automated Calculations: Advanced algorithms power the calculator, automating the calculation process and delivering swift results, freeing up users' time for other critical tasks.

- Real-time Results: The calculator provides real-time tax estimations, eliminating the need for lengthy periods and enabling users to make informed decisions promptly.

- Reduced Research Time: By consolidating all necessary tax information in one place, the calculator eliminates the need for extensive research, saving users countless hours of searching and gathering data.

Collectively, these facets of time-saving coalesce to provide users with a streamlined and efficient tax calculation experience. The simplified interface, automated calculations, real-time results, and reduced research time empower users to navigate the complexities of import tax computations swiftly and effectively, freeing up their valuable time for other aspects of the used car import process.

Comprehensive: Calculations cover all relevant import taxes

Within the realm of "Tra Calculator 2023 Used Car Import Tax", "Comprehensive: Calculations cover all relevant import taxes" emerges as a defining attribute, encompassing a holistic approach to tax computations. This characteristic ensures that users can confidently rely on the calculator to provide accurate and inclusive tax estimations, encompassing the entirety of import tax obligations.

- Customs Duty: The calculator seamlessly incorporates customs duty, a levy imposed on the value of imported goods, into its calculations, ensuring that users are fully aware of this essential component of import taxes.

- Excise Duty: Excise duty, a tax levied on specific goods such as fuel and alcohol, is meticulously accounted for within the calculator's computations, providing a comprehensive view of import tax liabilities.

- Value-Added Tax (VAT): The calculator takes into consideration value-added tax, a consumption tax levied on the value added to goods and services at each stage of production and distribution, ensuring that users have a clear understanding of this prevalent import tax.

- Other Import Taxes: Beyond the aforementioned primary import taxes, the calculator also encompasses other relevant import taxes, ensuring that users are fully informed of all applicable levies and duties.

Collectively, these facets of comprehensiveness empower users with a holistic understanding of the import tax landscape. By incorporating all relevant import taxes into its calculations, "Tra Calculator 2023 Used Car Import Tax" provides users with a comprehensive and reliable tool for making informed decisions regarding their used car imports.

Up-to-date: Reflects the latest tax regulations

Within the realm of "Tra Calculator 2023 Used Car Import Tax", "Up-to-date: Reflects the latest tax regulations" stands as a cornerstone, ensuring that the calculator's tax estimations align precisely with the ever-evolving landscape of import tax policies and regulations. This attribute manifests in several key facets:

- Regular Updates: The calculator is subject to regular updates, incorporating the latest tax regulations and amendments as they emerge, ensuring that users have access to the most current and accurate tax information.

- Real-Time Data: The calculator leverages real-time data sources to provide up-to-date tax estimations, reflecting the most recent changes in tax policies and ensuring that users are fully informed of their tax obligations.

- Tax Authority Collaboration: The calculator collaborates closely with relevant tax authorities, ensuring that the embedded tax regulations are aligned with official guidelines and interpretations, enhancing the accuracy and reliability of tax estimations.

- User Feedback: The calculator actively incorporates user feedback into its development process, addressing any discrepancies or inconsistencies in tax calculations and ensuring that the calculator remains up-to-date with the latest tax regulations and industry best practices.

Collectively, these facets of "Up-to-date: Reflects the latest tax regulations" empower users with confidence in the accuracy of their tax estimations. By incorporating the latest tax regulations and amendments, the calculator ensures that users are fully aware of their import tax obligations and can make informed decisions regarding their used car imports.

Accessibility: Available online for easy access

Within the realm of "Tra Calculator 2023 Used Car Import Tax", " Accessibility: Available online for easy access" emerges as a cornerstone, profoundly impacting the calculator's utility and reach. This attribute manifests in several key ways:

Firstly, the calculator's online accessibility eliminates geographical barriers, allowing users from diverse locations to effortlessly access and utilize the tool. This accessibility is particularly crucial for individuals seeking to import used cars, as it enables them to conveniently calculate import taxes from anywhere with an internet connection.

Furthermore, the calculator's online presence ensures round-the-clock availability. Users can access the calculator at their convenience, regardless of time zones or business hours, empowering them to seamlessly integrate tax calculations into their schedules.

Real-life examples abound, showcasing the practical significance of " Accessibility: Available online for easy access" within "Tra Calculator 2023 Used Car Import Tax". Importers in remote areas, with limited access to traditional tax advisory services, have lauded the calculator's online accessibility for providing them with the means to accurately estimate import taxes.

The practical applications of this understanding are far-reaching. By harnessing the power of online accessibility, "Tra Calculator 2023 Used Car Import Tax" empowers individuals to make informed decisions regarding their used car imports. It simplifies the often-complex process of import tax calculation, enabling users to navigate the intricacies of international trade with greater confidence and efficiency.

Transparency: Clear breakdown of tax components

In the realm of "Tra Calculator 2023 Used Car Import Tax", " Transparency: Clear breakdown of tax components" stands out as a defining attribute, empowering users with a profound understanding of the import tax landscape. This transparency manifests in several key facets:

- Itemized Tax Components: The calculator provides users with a detailed breakdown of the various tax components that contribute to the overall import tax liability. This granular level of detail enables users to pinpoint the exact nature and amount of each tax, fostering a deep understanding of their tax obligations.

- Real-life Examples: To enhance comprehension, the calculator incorporates real-life examples that illustrate the practical application of tax components. These examples serve as valuable teaching tools, enabling users to visualize the impact of different factors on import tax calculations.

- Tax Calculation Logic: The calculator provides a transparent view of the underlying tax calculation logic, allowing users to scrutinize the methodology and assumptions used to arrive at the final tax estimation. This transparency instills confidence in the accuracy and reliability of the tool.

- Potential Tax Savings: By understanding the breakdown of tax components, users are empowered to identify potential areas for tax savings. This knowledge enables them to make informed decisions and optimize their import tax strategies.

Collectively, these facets of " Transparency: Clear breakdown of tax components" empower users with a comprehensive understanding of the import tax landscape. This transparency is not only essential for accurate tax calculations but also fosters trust and confidence in the tax estimation process. It empowers users to make informed decisions regarding their used car imports and navigate the complexities of international trade with greater clarity and peace of mind.

In conclusion, "Tra Calculator 2023 Used Car Import Tax" emerges as an indispensable tool for navigating the complexities of import tax calculations on used cars. Its accuracy, convenience, user-friendliness, time-saving capabilities, comprehensiveness, and transparency collectively empower users with a profound understanding of their import tax obligations.

Key insights gleaned from our exploration of "Tra Calculator 2023 Used Car Import Tax" include the tool's ability to:

- Provide precise tax estimations, ensuring accurate financial planning

- Streamline the tax calculation process, saving time and effort

- Foster transparency and understanding of the import tax landscape

These key points interconnect to empower users with the knowledge and confidence to make informed decisions regarding their used car imports. By embracing the insights and capabilities of "Tra Calculator 2023 Used Car Import Tax," individuals can navigate the complexities of international trade with greater clarity and efficiency.